Latest Blogs

Why You Should Buy Property in Jaipur

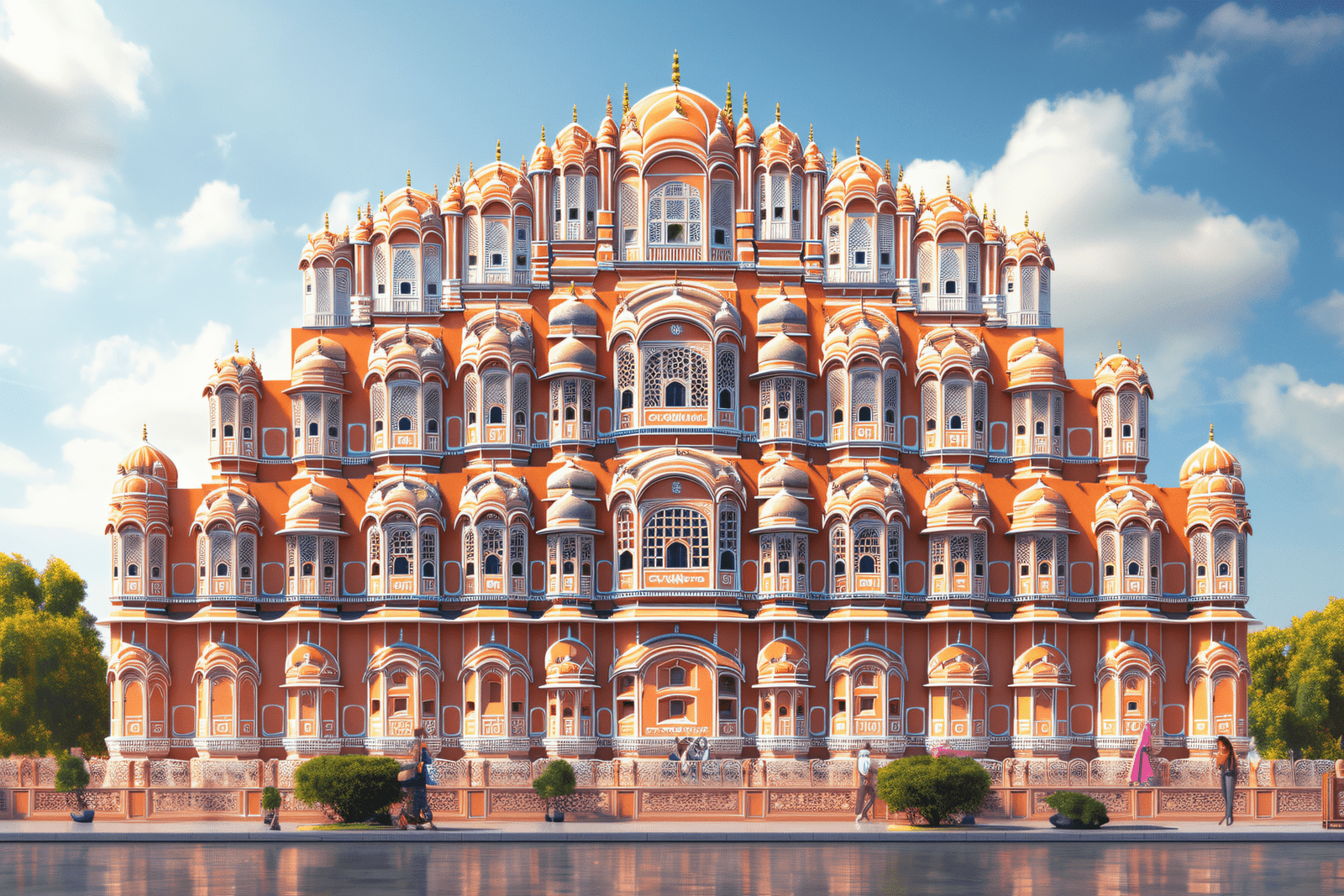

Jaipur, famously known as the Pink City of India, is one of the most beautiful and rapidly developing cities in the country.

While it has always been known for its rich history, royal architecture, and vibrant culture, Jaipur is now emerging as a major real estate investment hub in North India.

If you’re planning to buy property, Jaipur is one of the smartest choices you can make today.

Let’s explore why 👇

Why Jaipur is the Next Real Estate Hotspot After Gurgaon

For years, Gurgaon (Gurugram) has been the undisputed king of North India’s real estate market — home to global companies, luxury apartments, and massive infrastructure growth.

But in recent years, a new city has started making waves in the property market — Jaipur, the Pink City of India.

From affordable prices to smart city planning, Jaipur is now emerging as the next big real estate hotspot after Gurgaon.

Let’s dive into the reasons why 👇

Pune Real Estate Market 2026: Complete Investment Guide, Price Predictions & Emerging Hotspots

The Pune real estate market is heading into 2026 with momentum that’s catching everyone’s attention. After selling 90,000+ homes in 2025 worth over ₹65,000 crores, Pune has cemented its position as India’s most active residential real estate market. But here’s what matters for you in 2026: The dynamics are shifting. Areas that were “upcoming” in 2024 are now operational. Infrastructure that was promised for years is finally delivering. And prices? They’ve moved up, but opportunity gaps still exist if you know where to look. Whether you’re planning to buy your first home in 2026, considering an investment property, or wondering if last year’s delay was wise—this guide breaks down everything you need to know about the Pune real estate market 2026. We’ll cover realistic price predictions (not developer fantasies), actual infrastructure completion timelines, and honest assessments of which areas are genuinely worth your money in 2026 versus which ones are still overhyped. No sugarcoating. No sales pitch. Just the information you need to navigate Pune’s property market smartly in 2026. Let’s get started. Understanding the Pune Real Estate Market in 2026 Market Overview: What 2025 Set Up for 2026 The Pune real estate market enters 2026 on solid ground, but with interesting nuances. 2025 delivered approximately 90,000 residential unit sales across Pune Metropolitan Region—a milestone that confirms the city’s status as India’s residential real estate leader. The total transaction value crossed ₹65,000 crores, representing sustained buying activity beyond pandemic-era volatility. But the market has matured. Gone are the days of 20-25% annual price jumps in random micro-pockets. What we’re seeing in 2026 is more predictable, infrastructure-led growth ranging between 8-12% annually in established areas. The composition of buyers has shifted too. In 2026, first-time buyers account for only 45% of transactions (down from 60% in 2021). The rest? Upgraders, investors, and NRIs. This tells you something important: people are buying second properties or larger homes, not just entering the market. What’s Driving the Pune Real Estate Market 2026 Three primary forces are shaping the Pune property market in 2026, and they’re all tangible—not speculative. First, IT sector stability with expansion. Pune now employs 750,000+ IT professionals. While the hiring frenzy of 2021-2023 has cooled, companies are still expanding physical presence. When TCS inaugurates a new 10,000-seat facility in Hinjewadi Phase 3 (scheduled for Q2 2026), that creates immediate housing demand. Second, infrastructure delivery—not promises. This is where 2026 differs from previous years. The Pune Metro Phase 1 isn’t “coming soon”—it’s operational and carrying 200,000+ passengers daily. The Ring Road’s first segments are opening. The Purandar Airport has moved from land acquisition to construction phase. Third, genuine affluence growth. Pune’s per capita income crossed ₹3.8 lakhs in 2025. That’s real purchasing power growth, not just inflation. Combined with dual-income households being the norm in IT families, you’re seeing buyers comfortably afford ₹80 lakh – ₹1.2 crore properties that were considered “premium” five years ago. Market Segments: Where the Action Is in 2026 The Pune real estate market 2026 shows clear segmentation, and understanding which segment you’re targeting matters. Affordable Housing (Under ₹60 lakhs): Shrinking but not dead. Approximately 30% market share. You’ll find options in Wagholi, Moshi, Talegaon, and parts of Pimpri-Chinchwad. Many projects in this segment are on the city’s periphery, requiring longer commutes but offering actual ownership affordability. Mid-Range Properties (₹60 lakhs – ₹1.3 crores): This is the sweet spot—about 45% of all transactions happen here. Areas like Wakad, Punawale, Hadapsar, Undri, and parts of Kharadi cater to this segment. In 2026, this segment benefits most from completed infrastructure projects. Premium Segment (₹1.3 – ₹3.5 crores): Growing aggressively. Now 20% of market versus 12% in 2021. Baner, established Kharadi, Viman Nagar, Aundh, and NIBM Road dominate. Quality construction, brand builders, and superior amenities justify the premium. Luxury Properties (₹3.5 crores+): The surprise performer. Sales in this segment grew 6X from 2021 to 2025, and 2026 shows no slowdown. Koregaon Park, Kalyani Nagar, Boat Club Road, and premium pockets of Baner see consistent demand from successful entrepreneurs, NRIs, and high-net-worth families. One trend to watch in 2026: 3BHK apartments are outselling 2BHK in the ₹80 lakh – ₹1.5 crore range. Post-pandemic work-from-home normalization means that extra room isn’t optional—it’s essential for many families. Pune Property Prices 2026: Area-Wise Predictions Let’s talk numbers. Not “starting from” asterisk-laden prices, but realistic ranges you’ll encounter when actually hunting for properties in 2026. West Pune: The IT Hub Belt Hinjewadi remains Pune’s employment engine, with prices reflecting that reality. What changed in 2026: Phase 3 is no longer “emerging”—it’s established. Multiple projects have delivered possession, and the commute infrastructure (improved roads, metro extension in progress) has caught up. If you work in Hinjewadi, Phase 2 offers the best value-to-convenience ratio in 2026. Baner has solidified as a premium residential destination. The catch? Limited new inventory. Most available properties in 2026 are resales or redevelopments. If you find a good deal here, move fast—competition is real. Wakad is the metro connectivity winner. Why Wakad matters in 2026: The metro station here isn’t new anymore, but its impact is fully visible. Commute times to major hubs have genuinely reduced by 30-40%. Properties purchased in 2023-24 when metro was brand new are already showing 18-22% appreciation. Balewadi and Aundh cater to established families and premium buyers. Both areas offer limited volatility and steady appreciation (8-10% annually). You’re paying for peace of mind and quality social infrastructure. East Pune: The Balanced Choice Kharadi in 2026 is a mature, established IT hub. The 2026 reality: Kharadi won’t give you 20% annual appreciation anymore—those days are gone. What it offers instead is stability, liquidity (easy resale), and genuine livability. For end-users, that’s often more valuable than chasing speculative gains. Hadapsar serves the mid-range buyer well. Ring Road segments near Hadapsar are opening in phases through 2026, which should provide a 5-8% additional appreciation boost beyond normal market growth. Wagholi in 2026 is a mixed story. Some projects have matured beautifully with delivered infrastructure and happy residents. Others continue struggling

Hyderabad Real Estate Market 2026: Investment Forecast, Emerging Areas & Price Predictions

Picture this: You’re standing in what is today an empty plot along Hyderabad’s upcoming Regional Ring Road. Fast forward to 2026, and this very spot could be surrounded by bustling townships, metro stations, and thriving commercial hubs. This isn’t speculation—it’s the trajectory of one of India’s most promising property markets. The Hyderabad real estate market 2026 is shaping up to be a pivotal year for investors and homebuyers. After witnessing 64% cumulative appreciation from 2019 to 2024 and recording over 20,000 unit sales in Q3 2025 alone, the city is entering its next growth phase. Major infrastructure projects like the Regional Ring Road (RRR) will begin becoming operational, Metro Phase 2 will connect new corridors, and emerging areas will transition from “upcoming” to “arrived.” But here’s what makes 2026 different from previous years: This is when Hyderabad’s long-promised infrastructure actually starts delivering results. When the metro reaches previously disconnected areas. When the RRR cuts travel times dramatically. When today’s peripheral zones become tomorrow’s prime locations. If you’re wondering whether to invest now or wait, which areas will dominate in 2026, or how prices will move, you’re asking the right questions. This comprehensive guide examines the Hyderabad real estate market 2026 through the lens of data, infrastructure timelines, and ground realities—not just optimistic projections. Whether you’re a first-time buyer planning your dream home, an investor seeking high-return opportunities, or an NRI wanting to invest in India’s growth story, this guide will help you navigate 2026’s opportunities and challenges with clarity. Let’s explore what the Hyderabad real estate market 2026 holds for you. State of Hyderabad Real Estate Market 2026: What’s Changed The Evolution from 2025 to 2026 The Hyderabad real estate market 2026 inherits strong momentum from 2025 but with crucial differences. While 2025 was about recovery and growth, 2026 is about maturity and selective expansion. In 2025, the market saw 52% quarter-over-quarter growth in Q3, with over 20,000 units sold. The premiumization trend accelerated, with 49% of sales in the premium segment (₹1.5 crore+). But January 2025’s marginal dip in registrations signaled that the market is becoming more discerning, not just blindly bullish. As we move into 2026, several factors have evolved: Inventory Correction in Luxury Segment: The 6% year-on-year increase in unsold luxury inventory above ₹2 crores seen in 2025 is beginning to normalize. Developers have slowed new luxury launches, allowing demand to catch up. This means better deals for luxury buyers in 2026. Infrastructure Delivery vs. Promises: Unlike previous years where infrastructure was “coming soon,” 2026 sees actual project completions. Parts of Metro Phase 2 are becoming operational, and RRR construction is visibly progressing. This shifts investment from speculative to grounded. Employment Landscape: The IT sector, which employs 600,000+ professionals, continues expanding with new GCC (Global Capability Centers) openings. But 2026 also sees growth in pharma, manufacturing, and logistics sectors, diversifying the economic base. Current Market Snapshot (Early 2026) Property registrations in early 2026 show steady momentum. The market has digested the January 2025 pause and returned to growth mode. Monthly registrations average 6,200-6,800, up from 5,400-5,900 in early 2025—indicating healthy 12-15% year-over-year growth. The weighted average property price has risen 8-10% from 2025 levels, slightly moderating from the 10-15% annual appreciation seen in 2023-2024. This moderation is healthy—it suggests sustainable growth rather than a bubble. What’s particularly interesting about the Hyderabad real estate market 2026 is the geographic shift. While western corridors (Gachibowli, Kondapur, Kokapet) remain strong, northern and southern corridors are gaining share. Areas like Kompally, Shamshabad, and Adibatla are no longer “upcoming”—they’re actively transacting. The Demographic Shift Who’s buying in 2026? The profile is evolving: Millennials Moving Up: First-time buyers from 2020-2022 are now upgrading from 2BHK to 3BHK apartments. This “trade-up” market is supporting mid-segment demand (₹60-90 lakhs). Gen-Z Enters the Market: Professionals born in the late 1990s, now 27-30 years old with 5-7 years of work experience, are becoming first-time buyers. They prioritize amenities, sustainability, and tech integration over size. NRI Investment Surge: With rupee depreciation making Indian real estate more attractive (in dollar terms) and remote work enabling flexible living, NRI investment in Hyderabad property has grown 20-25% year-over-year. Retirees Seeking Lifestyle: The 55+ demographic is increasingly choosing Hyderabad for retirement—lower cost of living than Mumbai/Delhi, excellent healthcare, and pleasant lifestyle. This is driving demand for low-rise villas and gated communities. Major Infrastructure Milestones Shaping 2026 Infrastructure is the single biggest factor influencing the Hyderabad real estate market 2026. Here’s what’s changing on the ground. Metro Phase 2: Connectivity Transformation The Hyderabad Metro Phase 2 expansion is Hyderabad’s game-changer for 2026. Several corridors are now operational or entering final testing: Old City Connectivity: The metro extension to Old City areas like Falaknuma and Chandrayangutta is transforming neighborhoods that were previously overlooked. Properties within 1 km of these stations have seen 15-20% appreciation even before full operations began. Airport Line Progress: The Raidurg to Shamshabad airport metro corridor, planned as a 40-minute connection, has significant sections under construction. Once operational (expected late 2026 or early 2027), areas along this route—Narsingi, Puppalguda, and Shamshabad—will see dramatic value increases. Eastern Expansion: Nagole to LB Nagar to Hayathnagar extension brings metro connectivity to eastern Hyderabad, historically underserved. This is opening entirely new residential markets for buyers seeking affordability with connectivity. Impact on Property Values: Historical data from Phase 1 shows that areas within 500 meters of metro stations saw 25-35% appreciation over three years post-operation. Buyers in 2026 still have a window to enter Phase 2 corridor properties before this appreciation fully materializes. Regional Ring Road (RRR): The Mega Catalyst The 350-kilometer Regional Ring Road is Hyderabad’s most ambitious infrastructure project, and 2026 marks visible construction across multiple stretches. While full completion is still 3-4 years away, the impact is already being felt. Land Acquisition Complete: Most land acquisition is finalized, removing a major uncertainty. Investors can now assess RRR routes with confidence. Nodal Point Development: Six major nodal points along the RRR are being developed as mini-townships with residential, commercial, and logistics hubs. Areas

Bangalore Real Estate Market 2026: Complete Guide to Prices, Trends & Top Investment Areas

Rajesh stared at his laptop screen in disbelief. The 3BHK apartment in Sarjapur Road he’d bookmarked six months ago? The price had jumped from ₹1.8 crores to ₹2.1 crores. Welcome to the Bangalore real estate market in 2025. If you’re reading this, you’re probably in the same boat. Maybe you’re an IT professional tired of paying ₹35,000 monthly rent with nothing to show for it. Or an NRI looking to invest back home. Perhaps you’re a first-time buyer terrified of making a ₹1 crore mistake. This guide cuts through the noise. No developer fluff. No broker exaggerations. Just honest insights into what’s really happening in Bangalore’s property market right now. We’ll cover actual prices across different zones, reveal which areas offer genuine investment potential, expose overpriced pockets, and give you a framework to make confident decisions. By the end, you’ll know exactly where you stand in this fast-moving market. Let’s dive in. Understanding the Bangalore Real Estate Market: 2026 Overview The Bangalore real estate market isn’t just hot—it’s on fire. Transaction volumes in 2024 crossed ₹85,000 crores, with approximately 32,000 residential units sold across the city. That’s a 7% jump from 2023. Why the frenzy? Three big reasons. First, Bangalore’s IT sector isn’t slowing down. Companies like Amazon, Google, and Microsoft continue expanding. Global Capability Centers (GCCs) are mushrooming—these are fancy terms for big company offices that employ thousands of well-paid professionals who need homes. Second, infrastructure is finally catching up. Namma Metro Phase 2 is operational on key routes. The Peripheral Ring Road and Satellite Town Ring Road projects are transforming suburban connectivity. Third, migration hasn’t stopped. Every month, thousands of young professionals move here chasing career dreams. They all need somewhere to live. But here’s where it gets interesting. Supply hasn’t kept pace with demand, especially in prime locations. Developers are launching projects, sure, but approvals take time. RERA regulations (more on this later) have cleaned up the market but also slowed down reckless construction. The result? A seller’s market in most zones. Builders have pricing power. Buyers have less room to negotiate than they did five years ago. Current sentiment? If you’re buying to live in the property—especially in established areas—it’s a decent time. Rental costs are insane, often matching EMI payments. If you’re a pure investor chasing quick flips, tread carefully. The easy money days of 30% annual appreciation are behind us. Bangalore Property Prices 2026: What You’re Actually Paying Let’s talk numbers. Real ones. The citywide average for apartments sits around ₹8,500 per square foot as of January 2025. But that number means nothing when you’re actually buying. Bangalore isn’t one market—it’s a dozen micro-markets with wildly different pricing. Premium Central Locations: ₹11,000-₹15,000/sq ft Indiranagar, Koramangala, Jayanagar—these aren’t just neighborhoods, they’re legacy addresses. A 3BHK here costs ₹2.5-₹4 crores easily. You’re paying for prestige, established social infrastructure, and minimal commute to central business districts. Frazer Town commands ₹13,000 per sq ft. Cunningham Road touches ₹15,000. These areas aren’t for first-time buyers. They’re for upgraders and those who value location above everything else. Established IT Corridors: ₹8,000-₹12,000/sq ft Whitefield, Marathahalli, Electronic City, Sarjapur Road—this is where the action is. A typical 2BHK (1,200 sq ft) in a decent Whitefield project costs ₹1.1-₹1.4 crores. Three-bedroom units range from ₹1.6-₹2.2 crores. Specific example: Prestige projects near Varthur Lake are quoting ₹9,800 per sq ft. Sobha’s offerings on Sarjapur Road touch ₹11,200 for premium towers. Emerging Areas: ₹5,000-₹8,000/sq ft North Bangalore—Devanahalli, Yelahanka, Thanisandra—offers better bang for your buck. You can still find 3BHK apartments under ₹1.5 crores. Devanahalli properties near the Aerospace Park average ₹6,500 per sq ft. That’s a full ₹3,000 cheaper than Whitefield for similar specifications. Peripheral Zones: ₹3,500-₹6,000/sq ft Magadi Road, outskirts of Hosur Road, areas beyond Sarjapur—these are long-term bets. Prices are attractive but ask yourself: will you actually live here or is this pure speculation? What Changed in the Last 12 Months? Here’s the uncomfortable truth: prices jumped 12-18% across most zones in 2024. Whitefield saw 15% appreciation. North Bangalore surged 18-20% in select pockets. Why? Limited inventory met strong demand. Developers learned they don’t need to compete on price—buyers are buying anyway. Are These Prices Justified? Depends who you ask. Compared to Mumbai (₹15,000-₹35,000 per sq ft) or Delhi NCR (₹8,000-₹20,000), Bangalore looks reasonable. Compared to Pune (₹6,000-₹10,000) or Hyderabad (₹5,500-₹9,000), we’re expensive. The price-to-income ratio tells the real story. The average IT professional earning ₹15 lakhs annually can barely afford a ₹1 crore apartment with a 20% down payment. That’s stretching. Hidden Costs You Can’t Ignore That ₹1.5 crore apartment? You’re actually paying closer to ₹1.75 crores once you factor in: Budget for the real number, not the advertised price. Top Investment Areas in Bangalore Real Estate (2026 Analysis) Where should you actually put your money? Let’s break it down zone by zone. North Bangalore: The Rising Star North Bangalore isn’t emerging—it’s arrived. And it’s still relatively affordable. Devanahalli & Aerospace SEZ Zone Kempegowda International Airport isn’t just about catching flights. The entire ecosystem around it is transforming. Aerospace Park, defense manufacturing units, and upcoming IT parks are creating jobs. Properties here range from ₹5,500-₹7,500 per sq ft. A 3BHK costs ₹1.2-₹1.6 crores. The Peripheral Ring Road will cut travel time to Whitefield to under 45 minutes. Who should buy here: Long-term investors (5-7 year hold), NRIs planning retirement, aviation sector professionals. Who shouldn’t: People working in South Bangalore, those needing immediate social infrastructure. Yelahanka & Thanisandra Yelahanka offers something rare in Bangalore—space. Villa plots are still available. The upcoming Yellow Line metro extension is a game-changer. Prices: ₹6,000-₹8,500 per sq ft. Brigade, Sobha, and Prestige have major township projects here with schools, hospitals, and retail built-in. Who should buy here: Families wanting integrated townships, those willing to bet on metro connectivity. Hebbal & Manyata Tech Park Vicinity This is the most mature part of North Bangalore. Manyata Tech Park employs over 100,000 people. Hebbal Lake adds lifestyle appeal. Prices have already appreciated significantly: ₹9,000-₹12,000 per sq ft. Less upside potential

Contact

Info@jayporehomes.com

+1-202-555-0140

4th Floor, Plot no.303A, Mahaveer Nagar, Mahaveer Nagar 2, Maharani Farm, Gayatri Nagar B, Durgapura, Jaipur, Rajasthan 302018

© 2025 Created with all rights reserved by Jayporehomes